| This article is part of a series on |

| Taxation in the United States |

|---|

|

|

|

% of income

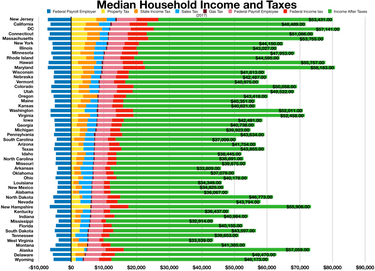

State tax levels indicate both the tax burden and the services a state can afford to provide residents.

States use a different combination of sales, income, excise taxes, and user fees. Some are levied directly from residents and others are levied indirectly. This table includes the per capita tax collected at the state level.

This table does not necessarily reflect the actual tax burdens borne directly by individual persons or businesses in a state. For example, the direct state tax burden on individuals in Alaska is far lower than the table would indicate. The state has no direct personal income tax and does not collect a sales tax at the state level, although it allows local governments to collect their own sales taxes. Alaska collects most of its revenue from corporate taxes on the oil and gas industry.

This table does not take into consideration the taxing and spending of local governments within states, which can vary widely, and sometimes disproportionately with state tax burdens.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search