Back الاثنين الأسود (1987) Arabic Joudasis pėrmadėinis BAT-SMG কালো সোমবার (১৯৮৭) Bengali/Bangla Černé pondělí Czech Schwarzer Montag German Μαύρη Δευτέρα (1987) Greek Lunes negro (1987) Spanish Astelehen Beltza (1987) Basque دوشنبه سیاه (۱۹۸۷) Persian Musta maanantai 1987 Finnish

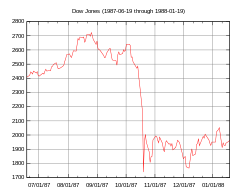

DJIA (June 19, 1987, to January 19, 1988) | |

| Date | October 19, 1987 |

|---|---|

| Type | Stock market crash |

| Outcome |

|

Black Monday (also known as Black Tuesday in some parts of the world due to time zone differences) was the global, severe and largely unexpected[1] stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion.[2] The severity of the crash sparked fears of extended economic instability[3] or even a reprise of the Great Depression.[4]

Possible explanations for the initial fall in stock prices include a nervous fear that stocks were significantly overvalued and were certain to undergo a correction, persistent US trade and budget deficits, and rising interest rates. Another explanation for Black Monday comes from the decline of the dollar, followed by a lack of faith in governmental attempts to stop that decline. In February 1987, leading industrial countries had signed the Louvre Accord, hoping that monetary policy coordination would stabilize international money markets, but doubts about the viability of the accord created a crisis of confidence. The fall may have been accelerated by portfolio insurance hedging (using computer-based models to buy or sell index futures in various stock market conditions) or a self-reinforcing contagion of fear.

The degree to which the stock market crashes spread to the wider (or "real") economy was directly related to the monetary policy each nation pursued in response. The central banks of the United States, West Germany, and Japan provided market liquidity to prevent debt defaults among financial institutions, and the impact on the real economy was relatively limited and short-lived. However, refusal to loosen monetary policy by the Reserve Bank of New Zealand had sharply negative and relatively long-term consequences for both its financial markets and real economy.[5]

- ^ Bates 1991, p. 1363; Seyhun 1990, p. 1009.

- ^ Schaede 1991, p. 42.

- ^ Group of 33.

- ^ Lobb 2007.

- ^ Grant 1997, p. 330.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search