Back Cupó (bo) Catalan Kupón Czech Kupon German Τοκομερίδιο Greek Kuponkikorko Finnish Coupon (finance) French Kupon (obligasi) ID Kupono IO 利札 Japanese Obligacja kuponowa Polish

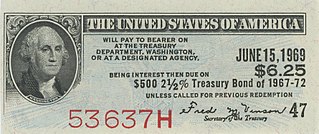

In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.[1]

Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.[2] For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each.[3]

- ^ "What Is a Bond Coupon, and How Is It Calculated?". Investopedia. Retrieved 2024-08-14.

- ^ Tammas-Hastings, Dan (2021-03-03). Liability-Driven Investment: From Analogue to Digital, Pensions to Robo-Advice. John Wiley & Sons. p. 80. ISBN 978-1-119-44196-0.

- ^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 277. ISBN 0-13-063085-3.

{{cite book}}: CS1 maint: location (link)

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search