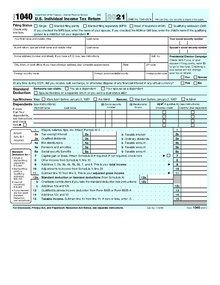

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

Income tax returns for individual calendar-year taxpayers are due by Tax Day, which is usually April 15 of the following year, except when April 15 falls on a Saturday, a Sunday, or a legal holiday. In those circumstances, the returns are due on the next business day after April 15. An automatic extension until October 15 to file Form 1040 can be obtained by filing Form 4868 (but that filing does not extend a taxpayer's required payment date if tax is owed; it must still be paid by Tax Day).

Form 1040 consists of two pages (23 lines in total), not counting attachments.[1] The first page collects information about the taxpayer(s) and dependents. In particular, the taxpayer's filing status is reported on this page. The second page reports income, calculates the allowable deductions and credits, figures the tax due given adjusted income, and applies funds already withheld from wages or estimated payments made towards tax liability. On the right side of the first page is the presidential election campaign fund checkoff, which allows individuals to designate that the federal government give $3 of the tax it receives to the presidential election campaign fund.[2] Altogether, 142 million individual income tax returns were filed for the tax year 2018 (filing season 2019), 92% of which were filed electronically.[3][4]

- ^ "Form 1040 (2018)" (PDF). Internal Revenue Service. Archived (PDF) from the original on September 4, 2019. Retrieved September 7, 2019.

- ^ Ellis, Blake. "The real story behind the $3 tax checkoff box". CNN Money. Retrieved February 6, 2017.

- ^ "IRS efile Tax Return and Refund Statistics for All Tax Years". www.efile.com. Retrieved September 8, 2019.

- ^ "Filing Season Statistics for Week Ending May 10, 2019 | Internal Revenue Service". www.irs.gov. Retrieved September 8, 2019.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search