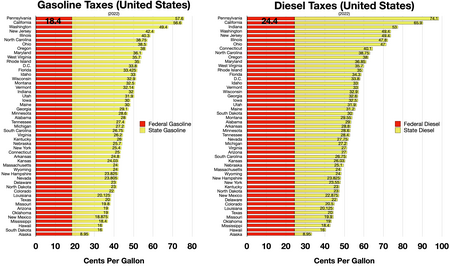

Federal Taxes

State Taxes

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel.[1][2] Proceeds from the tax partly support the Highway Trust Fund. The federal tax was last raised on October 1, 1993, and is not indexed to inflation, which increased 111% from Oct. 1993 until Dec. 2023. On average, as of April 2019[update], state and local taxes and fees add 34.24 cents to gasoline and 35.89 cents to diesel, for a total US volume-weighted average fuel tax of 52.64 cents per gallon for gas and 60.29 cents per gallon for diesel.[3]

- ^ "Petroleum Marketing Explanatory Notes: The EIA-782 survey" (PDF). US Energy Information Administration/Petroleum Marketing Monthly.

- ^ http://www.fhwa.dot.gov/infrastructure/gastax.cfm US Department of Transportation, Federal Highway Administration: When did the Federal Government begin collecting the gas tax?

- ^ "State Motor Fuel Taxes: Notes Summary" (PDF). American Petroleum Institute. April 1, 2019.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search