Back Cupó (bo) Catalan Kupón Czech Kupon German Τοκομερίδιο Greek Kuponkikorko Finnish Coupon (finance) French Kupon (obligasi) ID Kupono IO 利札 Japanese Obligacja kuponowa Polish

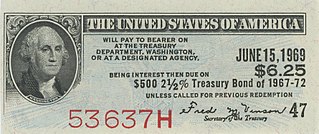

In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.

Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each.[1]

- ^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 277. ISBN 0-13-063085-3.

{{cite book}}: CS1 maint: location (link)

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search