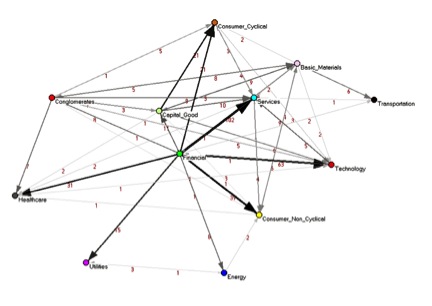

The dependency network approach provides a system level analysis of the activity and topology of directed networks. The approach extracts causal topological relations between the network's nodes (when the network structure is analyzed), and provides an important step towards inference of causal activity relations between the network nodes (when analyzing the network activity). This methodology has originally been introduced for the study of financial data,[1][2] it has been extended and applied to other systems, such as the immune system,[3] and semantic networks.[4]

In the case of network activity, the analysis is based on partial correlations.[5][6][7][8][9] In simple words, the partial (or residual) correlation is a measure of the effect (or contribution) of a given node, say j, on the correlations between another pair of nodes, say i and k. Using this concept, the dependency of one node on another node is calculated for the entire network. This results in a directed weighted adjacency matrix of a fully connected network. Once the adjacency matrix has been constructed, different algorithms can be used to construct the network, such as a threshold network, Minimal Spanning Tree (MST), Planar Maximally Filtered Graph (PMFG), and others.

- ^ Kenett, Dror Y.; Tumminello, Michele; Madi, Asaf; Gur-Gershgoren, Gitit; Mantegna, Rosario N.; Ben-Jacob, Eshel (20 December 2010). Scalas, Enrico (ed.). "Dominating Clasp of the Financial Sector Revealed by Partial Correlation Analysis of the Stock Market". PLOS ONE. 5 (12): e15032. Bibcode:2010PLoSO...515032K. doi:10.1371/journal.pone.0015032. ISSN 1932-6203. PMC 3004792. PMID 21188140.

- ^ Dror Y. Kenett, Yoash Shapira, Gitit Gur-Gershgoren, and Eshel Ben-Jacob (submitted), Index Cohesive Force analysis of the U.S. stock market, Proceedings of the 2011 International Conference on Econophysics, Kavala, Greece

- ^ Asaf Madi, Dror Y. Kenett, Sharron Bransburg-Zabary, Yifat Merbl, Francisco J. Quintana, Stefano Boccaletti, Alfred I. Tauber, Irun R. Cohen, and Eshel Ben-Jacob (2011), Analyses of antigen dependency networks unveil immune system reorganization between birth and adulthood, Chaos 21, 016109 Archived 2012-03-30 at the Wayback Machine

- ^ Kenett, Yoed N.; Kenett, Dror Y.; Ben-Jacob, Eshel; Faust, Miriam (24 August 2011). Perc, Matjaz (ed.). "Global and Local Features of Semantic Networks: Evidence from the Hebrew Mental Lexicon". PLOS ONE. 6 (8): e23912. Bibcode:2011PLoSO...623912K. doi:10.1371/journal.pone.0023912. ISSN 1932-6203. PMC 3161081. PMID 21887343.

- ^ Kunihiro Baba, Ritel Shibata, Masaaki Sibuya (2004), Partial correlation and conditional correlation as measures of conditional independence, Aust New Zealand J Stat 46(4): 657–774

- ^ Yoash Shapira, Dror Y. Kenett, and Eshel Ben-Jacob (2009), The Index Cohesive Effect on Stock Market Correlations, Journal of Physics B. vol. 72, no. 4, pp. 657–669

- ^ Kenett, Dror Y.; Shapira, Yoash; Madi, Asaf; Bransburg-Zabary, Sharron; Gur-Gershgoren, Gitit; Ben-Jacob, Eshel (27 April 2011). Scalas, Enrico (ed.). "Index Cohesive Force Analysis Reveals That the US Market Became Prone to Systemic Collapses Since 2002". PLOS ONE. 6 (4): e19378. Bibcode:2011PLoSO...619378K. doi:10.1371/journal.pone.0019378. ISSN 1932-6203. PMC 3083438. PMID 21556323.

- ^ Dror Y. Kenett, Matthias Raddant, Thomas Lux, and Eshel Ben-Jacob (submitted), Evolvement of uniformity and volatility in the stressed global market, PNAS

- ^ Eran Stark, Rotem Drori and Moshe Abeles (2006), Partial Cross-Correlation Analysis Resolves Ambiguity in the Encoding of Multiple Movement Features, J Neurophysiol 95: 1966–1975

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search