Back ضريبة الإنتاج Arabic Aksiz Azerbaijani Акциз Bashkir Акцыз Byelorussian Акцыз BE-X-OLD Акциз Bulgarian আবগারী শুল্ক Bengali/Bangla Spotřební daň Czech Punktafgift Danish Verbrauchsteuer (Deutschland) German

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excise is thus a tax that relates to a quantity, not a value, as opposed to the value-added tax which concerns the value of a good or service. Excises are typically imposed in addition to an indirect tax such as a sales tax or value-added tax (VAT). Typically, an excise is distinguished from a sales tax or VAT in three ways:

- an excise is typically a per unit tax, costing a specific amount for a volume or unit of the item purchased, whereas a sales tax or value-added tax is an ad valorem tax and proportional to the price of the goods,

- an excise typically applies to a narrow range of products, and

- an excise is typically heavier, accounting for a higher fraction of the retail price of the targeted products.

Typical examples of excise duties are taxes on alcohol and alcoholic beverages ; alcohol tax, for example, consists of a levy of n euros per hectolitre of alcohol sold ; manufactured tobacco (cigars, cigarettes, etc.), energy products (oil, gas, etc.), vehicles or so-called "luxury" products. The legislator's aim is to discourage the consumption of products it considers to have a negative externality, but sometimes excise duty is also levied on tea or coffee (sometimes referred to as sin tax).

More recently, excise duty has been introduced on certain forms of transport considered to be polluting (such as air transport) or on the consumption of products that generate polluting waste that is little or not at all recycled or harmful to the environment (such as electronic products, certain plastic packaging, etc.).

These are the oldest sources of revenue for governments around the world. In 2020, consumption taxes accounted for 30% of total tax revenues in OECD countries on average, equivalent to 9.9% of GDP in these countries.

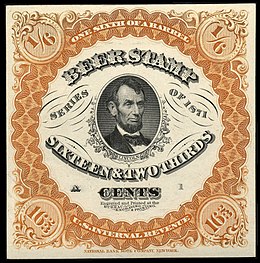

- ^ "6 2/3c Beer revenue stamp proof single". Smithsonian National Postal Museum. Retrieved 30 September 2013.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search