Back Lønsumsafgift Danish Lohnsteuer German Impuesto sobre la nómina Spanish Taxes sur les traitements et salaires French Doprinos Croatian Személyi jövedelemadó Magyarországon Hungarian 給与税 Japanese ពន្ធលើប្រាក់បៀវត្ស Cambodian Darbo užmokesčio mokesčiai Lithuanian Loonbelasting Dutch

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

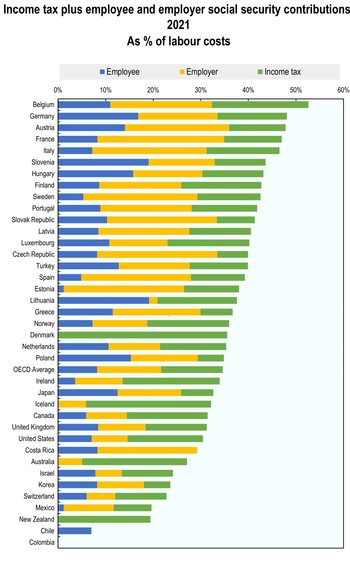

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees.[1] By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages.[1][2][3][4] Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education.[1]

- ^ a b c "The Knowledge Tax". University of Chicago Law Review. 82: 1981. 2015. SSRN 2551567.

- ^ Historical Effective Federal Tax Rates: 1979 to 2004. Congressional Budget Office. December 2006. p. 3.

- ^ "CBO’s analysis of effective tax rates assumes that households bear the burden of the taxes that they pay directly, such as individual income taxes and employees’ share of payroll taxes. CBO assumes—as do most economists—that employers’ share of payroll taxes is passed on to employees in the form of lower wages than would otherwise be paid. Therefore, the amount of those taxes is included in employees’ income, and the taxes are counted as part of employees’ tax burden." http://www.cbo.gov/sites/default/files/EffectiveTaxRates2006.pdf Page 3

- ^ "Incidence of Payroll Taxes is Fully on Employees" (PDF). 13 July 2010. Archived from the original (PDF) on 13 July 2010. Retrieved 31 March 2018.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search