Back Huntington National Bank Danish Huntington Bancshares Spanish هانتینگتون بانکشیرز Persian Huntington Bancshares French Huntington Bancshares Kirghiz Huntington Bancshares Russian Huntington Bancshares SAH Huntington Bancshares Uzbek 亨廷頓銀行 Chinese

The Huntington Center, the company's headquarters | |

| Huntington National Bank | |

| Formerly | P. W. Huntington & Company |

| Company type | Public |

| Nasdaq: HBAN S&P 500 Index component | |

| Industry | Banking |

| Founded | January 1866[1] as P. W. Huntington & Company in Columbus, Ohio[2] |

| Founder | P.W. Huntington |

| Headquarters | Columbus, Ohio 39°57′40″N 83°00′02″W / 39.961153°N 83.000594°W |

Area served | Colorado, Indiana, Kentucky, Minnesota, Michigan, Ohio, Pennsylvania, West Virginia, Illinois, and Wisconsin |

Key people | Stephen D. Steinour, Chairman, President & CEO Zachary Wasserman, CFO |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 25,693 (2021) [4] |

| Website | www |

| Footnotes / references [5] | |

Huntington Bancshares Incorporated is an American bank holding company headquartered in Columbus, Ohio. The company is ranked 466th on the Fortune 500 as of 2024[update],[6] and is 26th on the list of largest banks in the United States.[citation needed]

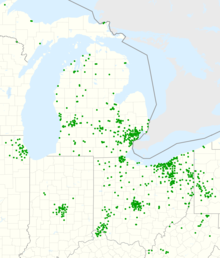

The company's banking subsidiary, The Huntington National Bank, operates 1047 banking offices, primarily in the Midwest: 459 in Ohio, 290 in Michigan, 80 in Minnesota, 51 in Pennsylvania, 45 in Indiana, 35 in Illinois, 32 in Colorado, 29 in West Virginia, 16 in Wisconsin and 10 in Kentucky.[7][8][4] In January 2009, the bank's Board of Directors named Steve Steinour as president, CEO, and chairman, succeeding Thomas Hoaglan, who retired after eight years in those positions.[8]

At the end of the 2021 fiscal year, Huntington was the nation's #1 originator of SBA 7(a) loans.[9]

- ^ "Huntington Private Bank". Florida Weekly. Bonita Springs. September 12, 2019. Retrieved June 20, 2023.

- ^ Ohio History Journal

- ^ a b c d "Huntington Bancshares, Inc. 2020 Annual Report Results" (PDF). December 31, 2020. Archived (PDF) from the original on May 13, 2021. Retrieved June 7, 2021.

- ^ a b c Manes, Nick (June 9, 2021). "Huntington Bank completes acquisition of TCF". Crain's Detroit Business. Archived from the original on June 9, 2021. Retrieved June 9, 2021.

- ^ "Huntington Bancshares Incorporated 2017 Form 10-K Annual Report". U. S. Securities and Exchange Commission. Archived from the original on April 29, 2018. Retrieved August 10, 2018.

- ^ "List of Fortune 500 companies". 50Pros. Retrieved March 10, 2024.

- ^ "Huntington Bank". Bank Branch Locator. Archived from the original on January 29, 2022. Retrieved January 28, 2022.

- ^ a b "Huntington hires Ex-Citizens Financial exec as CEO". The Columbus Dispatch. January 14, 2009. Archived from the original on October 2, 2022. Retrieved May 17, 2020.

- ^ Smith, Emily (October 8, 2021). "HUNTINGTON BANK TAKES TOP SPOT NATIONALLY FOR SBA 7(A) LOAN ORIGINATION BY VOLUME FOR FOURTH CONSECUTIVE YEAR". huntington-ir.com. Archived from the original on June 8, 2022. Retrieved July 7, 2022.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search