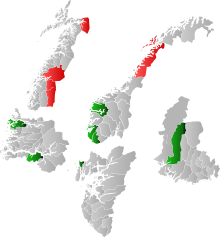

The Terra Securities scandal was a scandal that became public in November 2007. It involved highly speculative investments by eight municipalities of Norway in various hedge funds in the United States bond market.[1] The funds were sold by Terra Securities to the municipalities, while the products were delivered by Citigroup. The municipalities involved were Narvik, Rana, Hattfjelldal and Hemnes in Nordland, Vik and Bremanger in Sogn og Fjordane, Haugesund in Rogaland, and Kvinesdal in Vest-Agder, all large producers of hydroelectricity.

The investments were very complicated. They were geared, and they involved high risk through a small upside but a very large downside. Terra Securities, now bankrupt, was a subsidiary of Terra Markets, which is owned 66.73% by Terra-Gruppen, an alliance and co-branding company owned by 78 local savings banks in Norway. The remaining 33.27% was owned by the management of the company. Citigroup is the third largest bank in the United States.

- ^ Mark Landler: "U.S. Credit Crisis Adds to Gloom in Arctic Norway" New York Times, December 2, 2007 (Retrieved on December 2, 2007)

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search