Back Nassim Nicholas Taleb Afrikaans نسيم نقولا طالب Arabic نسيم نقولا طالب ARZ نسیم نقولا طالب AZB Насим Талеб Bulgarian নসীম নিকোলা তালেব Bengali/Bangla Nassim Nicholas Taleb Catalan Nassim Nicholas Taleb Czech Nassim Nicholas Taleb Danish Nassim Nicholas Taleb German

Nassim Nicholas Taleb | |

|---|---|

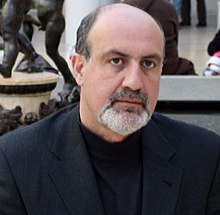

Taleb in 2010 | |

| Born | 12 September 1960 (age 63) Amioun, Lebanon |

| Nationality | Lebanese and American |

| Alma mater |

|

| Known for | Applied epistemology, antifragility, black swan theory, ludic fallacy, antilibrary |

| Awards | Bruno Leoni Award, Wolfram Innovator Award |

| Scientific career | |

| Fields | Decision theory, risk, probability |

| Institutions | New York University Tandon School of Engineering, University of Massachusetts Amherst, Courant Institute of Mathematical Sciences |

| Thesis | The Microstructure of Dynamic Hedging (1998) |

| Doctoral advisor | Hélyette Geman |

| Website | fooledbyrandomness |

Nassim Nicholas Taleb[a] (/ˈtɑːləb/; alternatively Nessim or Nissim; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist[1][2] whose work concerns problems of randomness, probability, and uncertainty.

Taleb is the author of the Incerto, a five-volume philosophical essay on uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008.[3][4][5][6][7] He has been co-editor-in-chief of the academic journal Risk and Decision Analysis since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and is currently listed as a scientific adviser at Universa Investments.[8] The Sunday Times called his 2007 book The Black Swan one of the 12 most influential books since World War II.[9]

Taleb criticized the risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the late-2000s financial crisis.[10][11] He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events.[12] He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility,[13][14] as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.[15][16]

Cite error: There are <ref group=lower-alpha> tags or {{efn}} templates on this page, but the references will not show without a {{reflist|group=lower-alpha}} template or {{notelist}} template (see the help page).

- ^ Berenson, Alex (11 September 2009). "A Year Later, Little Change on Wall St". The New York Times.

Nassim Nicholas Taleb, a statistician, trader, and author, has argued for years that. ...

- ^ Maslin, Janet (16 November 2010). "Explaining the Modern World and Keeping It Short". The New York Times.

In his happily provocative new book of aphorisms, the fiscal prophet and self-appointed flâneur Nassim Nicholas Taleb aims particular scorn at anyone who thinks aphorisms require explanation. ...

- ^ "Hardcover Business Best Sellers". New York Times. 2 November 2008.

- ^ Cite error: The named reference

Slatewas invoked but never defined (see the help page). - ^ "Right Out Of The Blue". Businessworld. 24 April 2007. Archived from the original on 8 September 2009. Retrieved 14 October 2009.

- ^ "The third culture – Nassim Nicholas Taleb". Edge. Archived from the original on 24 July 2013. Retrieved 14 October 2009.

- ^ Cite error: The named reference

nyueduwas invoked but never defined (see the help page). - ^ "People at Universa Investments L.P." www.universa.net. Universa Investments L.P. Archived from the original on 23 July 2018. Retrieved 8 March 2018.

- ^ Appleyard, Bryan (19 July 2009). "Books that helped to change the world". The Sunday Times.

- ^ Patterson, Scott (3 November 2008). "October Pain Was 'Black Swan' Gain". The Wall Street Journal. Retrieved 14 October 2009.

- ^ Taleb, Nassim Nicholas. "How Do You Solve A Problem Like Uncertainty". IAI TV. Retrieved 14 February 2014.

- ^ "Brevan Howard Shows Paranoid Survive in Hedge Fund of Time Outs". Bloomberg News. 31 March 2009.

'black swans' – difficult-to-predict events that can wipe out a fund. The term was popularized by hedge fund manager and author Nassim Taleb."

- ^ Danchin, Antoine; Binder, Philippe M.; Noria, Stanislas (2011). "Genes | Free Full-Text | Antifragility and Tinkering in Biology (and in Business) Flexibility Provides an Efficient Epigenetic Way to Manage Risk". Genes. 2 (4): 998–1016. doi:10.3390/genes2040998. PMC 3927596. PMID 24710302.

- ^ "Antoine Danchin on The Anti-Fragile Life of the Economy". Project-syndicate.org. 1 May 2015. Retrieved 7 May 2015.

- ^ Derbyshire, J.; Wright, G. (2014). "Preparing for the future: development of an 'antifragile' methodology that complements scenario planning by omitting causation" (PDF). Technological Forecasting and Social Change. 82: 215–225. doi:10.1016/j.techfore.2013.07.001.

- ^ Mattos-Hall, J. A. (2014). Strategy Under Uncertainty: Open Innovation and Strategic Learning for the Iceland Ocean Cluster (Thesis) (Thesis).

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search